ESG outlook: How are responsible investing trends converging with broader economic realities?

Michelle Dunstan, Chief Responsibility Officer, Janus Henderson Investors

Note: The views expressed on these pages are the opinions of their respective author(s) only and do not necessarily reflect the views and opinions of UKSIF.

This website should not be taken as financial or investment advice or seen as an endorsement or recommendation of any particular company, investment or individual. While we have sought to ensure information on this site is correct, we do not accept liability for any errors.

ESG outlook: How are responsible investing trends converging with broader economic realities?

Michelle Dunstan, Chief Responsibility Officer, Janus Henderson Investors

Responsible investing is shifting from aspirational ESG ideals to financially material considerations, aligning with broader economic realities. Chief Responsibility Officer Michelle Dunstan’s 2026 outlook highlights the evolving definitions of “responsible” investments, and why companies need to adapt to “conscious consumer” demands.

The shift from moral imperatives to financial materiality marks a move from aspirational ideals to practical ESG integration. In 2026, responsible investing will balance short- and long-term outcomes, balancing financial priorities with social and environmental goals. We see three macro drivers shaping markets: geopolitical realignment, demographic shifts, and higher capital costs—signalling convergence between ESG trends and economic realities.

The impact of geopolitics: Rethinking what is “responsible”

Headline events in 2025 have driven renewed focus on certain sectors. Military escalation and increased defence spending – especially in Europe – have prompted a re-examination of historical aversions to this sector. Similarly, energy security concerns and increased demand driven by the acceleration of AI and datacentres have led to renewed interest in nuclear energy and natural gas. Tariffs have sharpened the focus on efficiency, competitiveness, and national security.

Many asset managers have responded by rescinding broad exclusions in defence and energy, causing some consternation among clients and asset owners. This raises a philosophical question: If what’s considered “responsible” can change so dramatically, where does that leave ESG-focused portfolios?

Financial materiality aligns with sustainable growth

In this context, asset managers are adopting thoughtful analysis and engagement to ensure adherence to humanitarian standards and effective risk management – indeed, companies in these sectors can contribute to social and economic resilience for sustainable growth. This is particularly true in defence, which historically has faced issues of bribery, corruption and human rights abuses, and energy, which presents its own set of ESG risks. Defence companies continue to face corruption and human rights concerns, while energy companies grapple with obvious environmental challenges.

A more case by case approach is emerging—one that emphasises direct engagement, scrutiny of practices, and a sober assessment of long term risks. The argument is less about moral positioning and more about recognising how geopolitical instability and energy dynamics affect financial resilience.

The impact of demographic and lifestyle shifts: health and wealth disrupt consumer preferences

Demographic and lifestyle changes are profoundly reshaping the healthcare and consumer sectors. Generational shifts, reinforced by regulation, technology and social media, are driving new behaviours around food, diet, and health management. The rapid adoption of weight loss drugs and heightened awareness of ultra-processed foods are redefining the fight against obesity. Governments are responding with legislation to address the economic strain of chronic diseases.

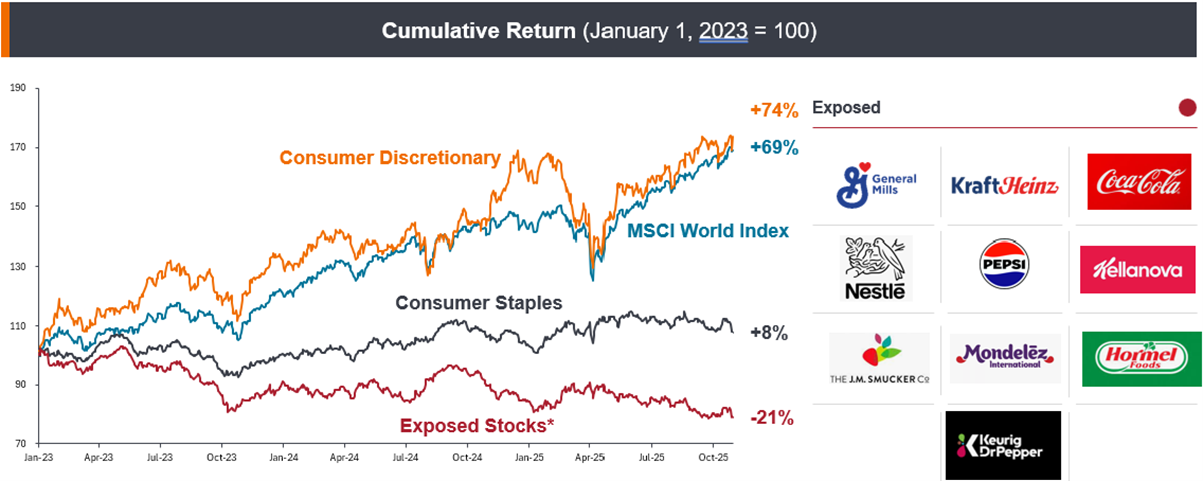

Technology has elevated access to information, and the social media visibility of “ideal” lifestyles is influencing both aspirations and actions. Consumers are increasingly seeking healthier, cleaner, and more sustainable choices, upending historical patterns in food & beverage, and wellness. Forward-thinking companies are adapting to meet the demands of the “conscious consumer,” creating winners and losers in the marketplace. This has typically led to significant underperformance for companies most exposed to the downside of these trends (image below). Asset managers are analysing these trends and engaging with companies to understand the long-term impacts.

The impact of costs: Pivot to real action in regulation, climate, and biodiversity

Geopolitics, tariffs, and the higher cost of capital have renewed focus on competitiveness and resilience, prompting a more practical approach to ESG. Ignoring these factors risks mispricing securities, so climate and biodiversity are now assessed for their measurable impact on financial performance. Investors are taking a more systematic approach to evaluating companies’ transition plans, exposure to regulatory change, and vulnerability to stranded assets.

The focus is less on whether companies make broad climate commitments and more on whether those commitments translate into credible actions that materially affect risk and return. Sustainability is no longer treated as a parallel layer of analysis but as a factor embedded directly in cash flow modelling and valuations.

A more grounded era for ESG

Rather than treating ESG as a separate framework, integration will continue to be critical amid disruptive megatrends like climate change and AI, which pose significant risks and opportunities for investors. As we look ahead through 2026, responsible investing trends are converging with broader economic realities. Instead of relying on sweeping principles or exclusion lists, investors are being pushed toward deeper analysis, more active engagement, and an acceptance that the definition of “responsible” will continue to evolve—often in response to forces outside the industry’s control.

You can read more on the Janus Henderson website here.

The views expressed on these pages are the opinions of their respective author(s) only and do not necessarily reflect the views and opinions of UKSIF.

This website should not be taken as financial or investment advice or seen as an endorsement or recommendation of any particular company, investment or individual. While we have sought to ensure information on this site is correct, we do not accept liability for any errors.