Sustainable Investing Is Stalling. AI Is the Accelerator

Lorenzo Saa, Chief Sustainability Officer, Clarity AI

Note: The views expressed on these pages are the opinions of their respective author(s) only and do not necessarily reflect the views and opinions of UKSIF.

This website should not be taken as financial or investment advice or seen as an endorsement or recommendation of any particular company, investment or individual. While we have sought to ensure information on this site is correct, we do not accept liability for any errors.

Sustainable Investing Is Stalling. AI Is the Accelerator

Lorenzo Saa, Chief Sustainability Officer, Clarity AI

Sustainable finance is at a turning point. After years of rapid growth, political pushback, regulatory complexity, and debates over performance have triggered reflection across the industry. For the first time in years, funds are flowing out of sustainability strategies in key markets.

This is a wake-up call. Sustainability isn’t a marketing label; it’s a long-term discipline. It demands a more rigorous approach and a renewed commitment. The irony? Just as the urgency of investing sustainably becomes more obvious, we risk pulling back.

The good news: we now have a powerful new tool at our disposal. Artificial intelligence (AI) offers the chance to rebuild trust in sustainable investing by grounding it in data and expanding its reach. Used wisely, AI can help sustainable investors not just survive the headwinds but turn them into tailwinds.

Lessons From the Setback

In dozens of recent conversations with investors, three realisations stand out.

• We haven’t always been candid: sustainability isn’t a free lunch in all situations. There are real trade-offs between impact and returns — especially in the short term — and over-enthusiastic messaging has sometimes drowned out necessary caution.

• Financial materiality remains fundamental. Rigid targets, like some of the net zero goals, may have contributed to underperformance, so it’s no surprise that greater focus on transition and long-term risk-adjusted returns is taking hold.

• Regulation, while important, has overreached. Today’s complexity risks diverting attention from outcomes. Simplification is welcome, but the shift must be toward investor-led focus.

As these truths emerge, one thing is clear: sustainability must be a method, not a slogan. AI can help make that shift real.

How AI Can Help

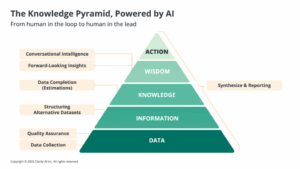

AI helps investors move up the knowledge pyramid — from raw data to insights, and ultimately to informed action.

First, it improves how investors access and interpret data. Insights buried in sustainability disclosures, academic papers and satellite imagery become usable. AI resolves the “too little versus too much” paradox, detects weak signals, connects patterns, and supports alpha and beta strategies.

Take transition finance. Our AI-driven research shows that only 40% of the top emitters disclose both decarbonisation measures and how they link to targets, both essential for credible plans. AI helps locate this data, sharpen engagement, and speed up due diligence.

AI also brings more companies into view. Most analysis focuses on a subset of global firms. AI expands that, including undercovered regions and businesses. This broadens opportunity sets and directs capital into new markets.

As Neil Brown of GIB Asset Management put it on our Sustainability Wired podcast: AI offers “an easier ability to drink from the firehose.”

When built with transparency, AI also builds trust. It can clarify where data comes from and how it’s processed. Traceable sources and methods help counter greenwashing and reinforce credibility.

AI also reduces compliance drudgery. With structured inputs and a human-in-the-loop, investors can automate large parts of reporting. Tools already support SFDR, SDR, ISSB, and TNFD — freeing time to focus on sustainable investing.

In a nutshell, AI is both a cheetah, accelerating what you already do, and an owl, revealing insights beyond reach. That dual value explains why Oliver Wyman estimates AI could boost productivity in asset management by up to 40%.

The Risks Are Real — and Manageable

No transformative technology is risk-free but, if well managed, the benefits of AI far outweigh the risks.

Governance and social concerns are real — and often linked. Many AI systems remain black boxes with limited explainability. Bias, hallucinations, and poor data quality are real risks — especially in portfolio construction.

Environmental impacts matter too. Large models require substantial energy and water. According to the IEA’s 2025 Energy and AI report, data centres use may double by 2030, rivaling Japan’s total electricity consumption today.

But as we outline in our Essentials of AI and ESG paper, these risks call for responsible adoption, not avoidance. Like fire, AI can be dangerous — but with fire alarms and firefighters, we use it safely. The same applies here: investors need transparency, strong governance, trained staff, and climate-aware tools.

What Investors Should Do Now

Start. Don’t wait for perfection. Learn by doing — test AI for research, screening, reporting. Build internal skills. McKinsey Digital shows staff are already using generative AI — leadership now needs to catch up.

UK investors are well-positioned. The government’s AI Opportunity Action Plan offers a balanced approach — more innovation-friendly than the EU, more protective than the US.

But starting doesn’t mean diving in blindly. Sustainable investing can’t run on ChatGPT alone. Investors need curated, transparent data and tested methodologies.

You can build your own tools — but it takes time. Partnering can speed adoption, boost quality, and free up internal capacity. You can even integrate models selectively, keeping control while outsourcing complexity. The choice is yours. But standing still is not.

In Short

This is a Bletchley Park moment for sustainable finance. Like the wartime codebreakers who embraced radical technology to change history, we face urgency, complexity — and opportunity. AI won’t solve every problem. But it can unlock smarter insights, reduce waste, and refocus sustainability on what matters.

Embrace it, and we might just turn the tide.

Note: The views expressed on these pages are the opinions of their respective author(s) only and do not necessarily reflect the views and opinions of UKSIF.

This website should not be taken as financial or investment advice or seen as an endorsement or recommendation of any particular company, investment or individual. While we have sought to ensure information on this site is correct, we do not accept liability for any errors.